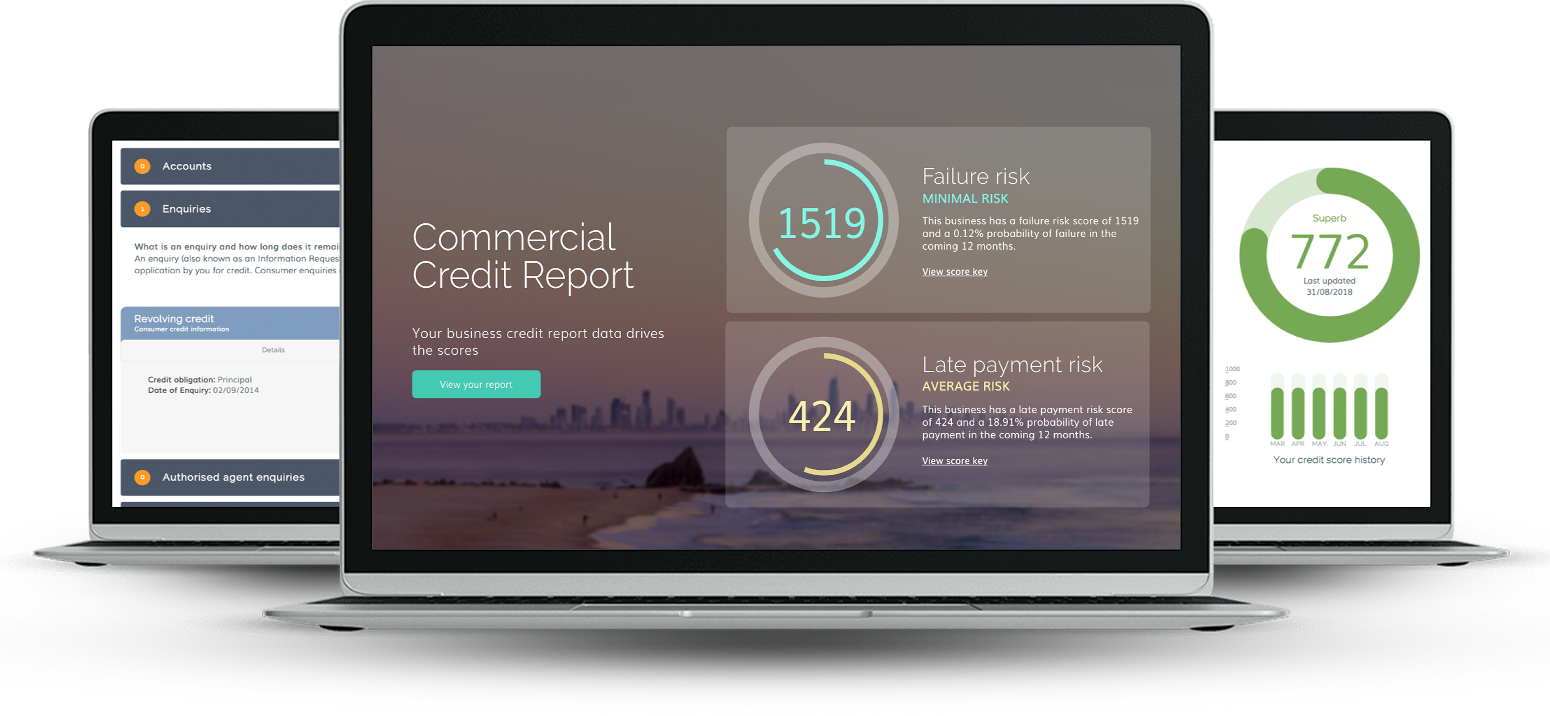

Economic Snapshot March 2024

With economic pressures continuing to mount, even essential services are starting to feel the pinch.

In the past few months, illion’s consumer bureau has been a considerable rise in telco delinquencies in New Zealand.

As telco services are seen as essential, consumers…